Fcf margin formula

SP 500 Average Valuation Multiples by Industry. Higher Gross Margin yoy Higher Asset Turnover yoy Apple Inc Filings.

Cash Flow Formula How To Calculate Cash Flow With Examples

Bombardiers cash flow from operating activities for Q2 was 422 million and net additions to PPE and.

. Levered FCF Millions US832m. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year. Price-to-DCF Earnings Based.

The reason why the pre-tax cost of debt must be tax-affected is due to the fact that interest is tax-deductible which effectively creates a tax shield ie. Operating Cash Flow Capital Expenditure and Net Working Capital. All-In-One Screener Ben Graham Lost Formula Canadian Faster Growers CEO Buys CEO Buys after Price Drop 20 Dividend Aristocrats 2022 Dividend Growth Portfolio Dividend Income Portfolio Fast.

Operating Margin Operating Income Revenue. It is calculated by dividing the net sales by the average fixed assets. Free Cash Flow Analysis.

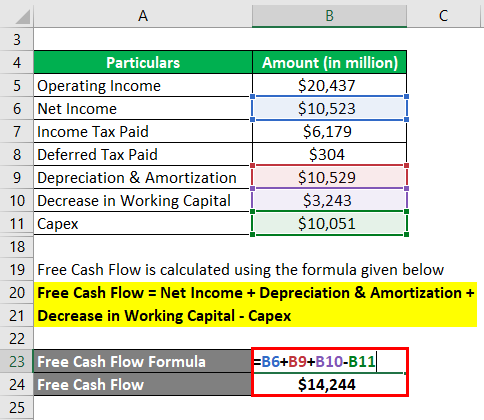

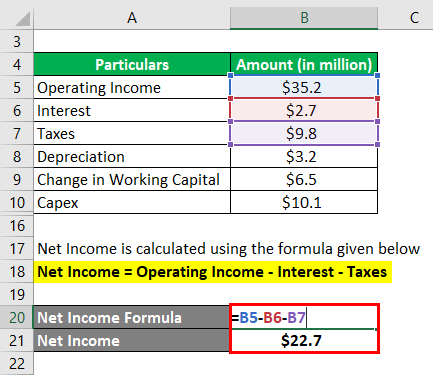

Here we discuss formula to calculate Profit Before tax along with examples advantages and disadvantages. Free Cash Flow Formula in Excel With excel template Here we will do the example of the Free Cash Flow Formula in Excel. The formula for assessing free cash flow is.

FCF Advisors LLC recently filed their 13F report for the second quarter of 2022 which ended on 2022-06-30. The operating cash flow can be found on the. Businesses calculate free cash flow to guide key business decisions such as whether to expand or invest in ways to reduce operating costs.

Free cash flow shows a companys ability to grow internally give profit back to its shareholders. This indicates that in a. It is measured using specific ratios such as gross profit margin EBITDA and net profit margin.

The fixed asset turnover ratio formula measures the companys ability to generate sales using the fixed assets investments. Fiserv now anticipates at least 100 basis points 100 percentage points of operating-margin expansion this year whereas it previously was targeting at least 150 basis points of expansion. HMCNYSE announced its Consolidated Financial Summary for the Fiscal 1st Quarter Ended June 30 2022 and Forecasts for the Fiscal Year Ending March 31 2023.

Return On Sales - ROS. You can easily calculate the Free Cash Flow using the Formula in the template provided. It is very easy and simple.

Return on sales ROS is a ratio used to evaluate a companys operational efficiency. The interest expense reduces the taxable income earnings. Investors use free cash flow calculations to check for accounting fraudthese numbers arent as easy to manipulate as earnings per share or net income.

You need to provide the three inputs ie. The fixed asset turnover ratio measures the efficiency of a company and is evaluated as a return on their investment in fixed assets such as. Operating Cash Flow Margin.

Honda Motor Co Ltd. The operating margin formula is the following. Adjusted EBITDA rose 41 YY to 201 million and the margin increased 350 bps to 129.

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. ROS is also known as a firms operating profit margin. ABB Ltd engages in manufacture and sale of electrification automation robotics and motion products for customers in utilities industry and transport and infrastructure in Switzerland and internationally.

This post displays the mostly commonly used valuation. The 13F report details which stocks were in a gurus equity portfolio at the end of the quarter though investors should note that these filings are limited in scope containing only a snapshot of long positions in US-listed stocks and American depository receipts as of the. In the calculation of the weighted average cost of capital WACC the formula uses the after-tax cost of debt.

FCF FCF The cash flow to the firm or equity after paying off all debts and commitments is referred to as free cash flow. A free cash flow FCF analysis calculates the amount of cash a company can put aside after it has paid its expenses at the end of an accounting period. As per the FCF formula FCF Operating Income Capital Expenditure Rs14026300 36749700-25653000 1848100 17559900 Rs14026300 37657800 Rs-30504700 As per the outcome of the free cash flow calculation it can be seen that the capital expenditure is more than the available free cash flow.

PE PFCF PS PB PEG There are many valuation multiples which investors use to compare stocks with their peers in an industry.

Free Cash Flow To Firm Fcff Formula And Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

There Are A Variety Of Business Valuation Methods To Choose From Learn Which One To Use Whe Business Valuation Financial Modeling Business Strategy Management

Financial Ratios Top 28 Financial Ratios Formulas Type Financial Ratio Debt To Equity Ratio Financial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Value Chain The Sustainability Enabled Business Value Chain Sustainability Business Supply Chain

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Unlevered Free Cash Flow Definition Examples Formula

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow Conversion Fcf Formula And Calculation Excel Template

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow Conversion Fcf Formula And Calculation Excel Template

Free Cash Flow Formula Fcf Calculation The Financial Falconet

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow To Firm Fcff Formulas Definition Example